Group Travel Insurance Rates – Get coverage for travel inconvenience and medical expenses (including pre-existing medical conditions and COVID-19) on your next vacation.

Travel with confidence and rediscover the world and discover the hidden gems in each city – because getting off the beaten path is the best way to truly satisfy your wanderlust. From untouched natural wonders to culinary secrets, make the most of your travel itinerary and explore hidden gems with peace of mind knowing you’re protected by your travel insurance.

Group Travel Insurance Rates

You never know what will happen when you travel. Whether it’s a flight cancellation due to bad weather or injuries caused by an accident, our travel insurance can cover your costs.

How To Find The Best Health Insurance Plan For You And Your Family

24/7 Medical Emergency Hotline: You can call (65) 6338 1222 for help in case of accident or medical emergency anywhere in the world.

For existing policyholders who purchased travel insurance before 10 April 2023 and travel commences after 10 April 2023, please see our COVID-19 Travel FAQ for more information.

You can quote the maximum amount we pay for each benefit segment under family cover on a single trip. Each insured person is given only the maximum benefit per insured person in the cover schedule.

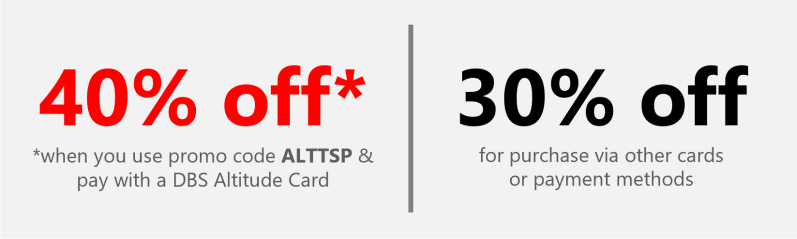

Find out how you can pay for your policy by choosing from the preferred methods below. For other accepted payment methods, you can contact us through your preferred contact mode.

Health Insurance For Foreigners In The Usa

Notice goes here. Lorem ipsum dolor sit amet consectetur adipiscing. Notice goes here. Lorem ipsum dolor sit amet consectetur adipiscing. Notice goes here. Lorem ipsum dolor sit amet consectetur adipiscing.

All the benefits covered in our travel insurance will only be effective while you are abroad except:

For personal accident, your cover starts when you leave the place you normally live or work (whichever is later) to start your journey, or three hours before the start date shown on your certificate of insurance, whichever is later. End of cover:

Yes, our travel insurance will cover you for all travel related benefits except for any condition arising out of any pre-existing medical condition you may have. If you have a pre-existing condition, we recommend you take out an enhanced PreX plan that covers pre-existing medical conditions. For coverage of pre-existing medical conditions, please refer to the Enhanced PreX Plans section.

Best Travel Insurance Plans To Buy In India 2023

The definition of pre-existing medical condition also applies to an injury or illness of your family member or travel companion.

Recreational activities accessible to general public/tourists like bungee jumping, scuba diving, motor cycle (including plane riding), horse riding, winter sports, water rafting are included in our standard policy terms.

However, dangerous or professional sports and activities are not covered under the terms of our policy. You can contact us on 6788 6616 if you want to check if the activity you are participating in is covered.

If my family consists of me, my father, my husband and my child traveling together, can I buy family cover?

International Private Medical Insurance Made Easy

You can consider buying a family cover for yourself, your spouse and your child, and include your father as an insured person. This can be done by selecting a plan for your family cover and then adding the insured on the next page.

If my child turns 18 this year, can I still insure him as a child? How much will the premium be?

Yes, children older than 30 days but less than 21 years of age can be insured as children. For details you may refer to the premium schedule available on our website.

If your child is traveling alone, you should purchase adult cover for him under Classic, Deluxe, Enhanced PreX Basic or Enhanced PreX Superior plan. If your child is 16 years of age or older, a policyholder can become a policyholder.

Health Insurance Costs Are Taking Biggest Jumps In Years

I will travel abroad for a year. Can I buy a travel insurance policy for a period of one year?

You can take a travel insurance plan for a maximum period of 180 consecutive days per trip for the Classic, Deluxe and Priority plans, and for a maximum period of 30 days for the Enhanced PreX plan. We are unable to accept coverage for more than 180 consecutive days.

No, your insurance period must cover your entire journey from the date of departure from Singapore to the date of arrival in Singapore.

Your insurance period will be automatically extended while you are abroad, at no additional premium for the first 14 days if:

Types Of Insurance Policies And Coverage You Need

Our policy covers people traveling abroad for business or pleasure. It is not intended to cover people traveling for medical treatment.

Yes, your travel insurance will cover the necessary and reasonable costs of emergency medical, surgical, hospital, dental and ambulance services prescribed or requested by a physician for your treatment abroad. Whereas, to the extent shown in the Cover Schedule. As per your plan or for a period of 45 days from the date of first treatment, whichever comes first.

Yes, we will pay for the necessary and reasonable expenses of emergency dental treatment prescribed or requested by a medical professional for your treatment up to the limit or for a period shown in your plan’s cover schedule when you seek treatment abroad. 45 days from the date of first treatment, whichever comes first.

Yes, our travel insurance will cover the cost of your specialist medical treatment if you are referred by a general practitioner. This is for 45 days from the date of first treatment or up to the policy limit, whichever is earlier.

Worldtrips Travel Insurance Review 2023

If I see a doctor after returning to Singapore, will my policy cover the medical expenses I incur?

Yes, we will pay necessary and reasonable expenses for medical, surgical, hospital, dental and ambulance treatment prescribed or requested by a medical practitioner in Singapore subject to the conditions listed below:

Yes, you can receive medical treatment from a Chinese medicine practitioner or chiropractor if the practitioner is registered with the Traditional Chinese Medicine (TCM) Practitioner Board and holds valid practicing certificates. You need to do this within three days of your return to Singapore and you have a maximum of 30 days to continue treatment.

Yes, a family member can visit you if you are hospitalized abroad for at least three days due to injury or illness during your trip and an adult family member is with you during that time. Don’t be together.

Travel Insurance Market Procurement Intelligence Report With Covid 19 Impact Analysis

We will pay reasonable economy class transportation costs (for air, sea or land travel) and hotel accommodation for a family member traveling and staying or a companion staying or traveling with you. Unless you are medically certified. medical practitioner to continue your journey or return to Singapore or within 30 days from the date of end of journey, whichever comes first.

Yes, we will pay benefits for each full 24-hour period you are hospitalized up to the amount shown in your plan’s cover schedule. This benefit will end after you leave the hospital abroad.

No, either our appointed support company will arrange and decide the most suitable means of export. This may include air ambulance, surface ambulance, regular air transport or any other appropriate means. You can be sure that our decisions will be based on your severity and medical needs.

Remittance of Home Benefit to you covers the repatriation and transportation costs of the insured’s body to Singapore or his home country. But the death was due to injury or illness abroad.

Etiqa Insurance Singapore

You will be able to cancel your travel benefit under the following conditions, if done within 30 days before your departure:

You will be eligible to cancel your Travel Benefit under the following conditions if they occur before your departure from Singapore:

*Family member means one’s spouse, children, parents, siblings, parents, brother, brother-in-law, grandfather, great-grandfather, grandmother, daughter-in-law, son-in-law or granddaughter.

We cover transport costs (air, sea or land travel) and accommodation costs that you have paid or agreed to pay under the contract and that you cannot refund (including travel agent cancellation fees) to the extent of the benefit. Your plan should first ask you to reimburse any prepaid expenses from the transportation or accommodation provider. We will deduct your claim from the amount refunded to you by the transport or accommodation provider.

Patriot Platinum Travel Medical Insurance

If I cancel my trip two months before my departure date due to a serious illness, is it covered by my travel insurance?

No, if you cancel your trip 30 days prior to your departure date from Singapore due to your critical illness, you will only be covered under the cancellation of your trip benefit of our travel insurance.

If

Group insurance rates, travel insurance rates, group travel rates, group life insurance rates, travel trailer insurance rates, small group health insurance rates, best travel insurance rates, group term life insurance rates, travel insurance compare rates, group health insurance rates, travel insurance rates comparison, intercontinental hotel group travel agent rates.