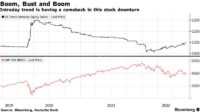

Stock Trading Strategies 2023 – After a disastrous 2022 in which the major stock indexes posted their worst performance since 2008, stock markets have started this year off to a strong start.

The 2023 U.S. market index is up 7.84% so far, with a 6.7% gain in January, marking its best monthly start in four years.

Stock Trading Strategies 2023

Whether this bull market turns out to be an upcoming or another bear market is a matter of debate with arguments from both sides. Key fault lines: Can the US economy avoid a recession; whether the Federal Reserve will keep rates higher for longer, pause or even ease; and the company’s earnings prospects.

Trading Strategies: What’s The Best Strategy For You?

With bulls, bears and year-end stock market declines, we checked the pulse of three Wall Street strategists.

Ed Yardeni, CEO of Yardeni Research, a provider of global investment research and strategic analysis, sees the stock market up 10-15% from current levels.

“We believe the post-October 12 rally is a real McCoy, the beginning of a new bull market, not just a rally within a bear market,” Yardeni says.

The basis for his optimistic forecasts is that the US economy will avoid a recession and instead make a “soft landing” in 2023. They forecast real growth in gross domestic product after taking into account inflation from zero to 1.5%. This will follow GDP growth of 2.1% in 2022, when GDP grew 3.2% in the third quarter and 2.9% in the fourth quarter, offsetting a weak first half.

Order Flow Trading Strategy

He admits that his favorable view is a minority view, but argues that for several years various segments of the economy have been in a “continuous recession”, the dynamics of which are resulting in slower growth but keeping a full recession at bay. Some evidence of an ongoing recession: Housing and retail are two industries that have experienced a severe downturn without negatively impacting the rest of the economy. They made huge profits during the pandemic years, but their fortunes changed when the Federal Reserve started raising interest rates. The auto industry has also struggled, never fully recovering from factory shutdowns and supply shortages during the pandemic, and consumers now face higher financing rates.

Despite the challenging environment facing tech companies and their headline-grabbing layoffs, “tech companies are not in danger of going bankrupt — they are just improving their margins,” Yardeni says.

Yardeni also notes that consumers continue to spend money, especially in the service sector. “Looking at the consumer, all this pessimism is perverse,” he says.

Yardeni says he’s not worried about one common sign of a recession: an inverted Treasury yield curve. For much of last year, short-term bond yields remained well above long-term bond yields as the Fed raised interest rates at the fastest pace in decades, signaling the possibility of an economic slowdown.

Top 3 Most Effective Trading Strategies

The inverted yield curve “has historically predicted a process leading to recession” because the Fed essentially caused a credit crunch in the economy. But this time, “I don’t think we’ll have a credit crunch even if the Fed raises interest rates another 50 basis points,” Yardeni says.

The Fed raised the federal funds rate from zero in early 2022 to its current target of 4.5% to 4.75%. The bond futures market suggests the Fed is expected to raise interest rates by half a percentage point by May.

Another pair of positives for the market in Yardeni’s eyes is that the dangerous recession predicted for the euro zone and China has not yet materialized, although their economies have slowed down significantly. He believes that the domestic and global economies are showing resilience.

Indeed, despite the war and inflation problems, the euro zone economy grew slightly, by 0.1%, in the fourth quarter as mild weather and government subsidies softened the impact of higher energy prices, according to Eurostat, the European Union’s statistics office. .

Pair Trading Strategies

The euro area economy showed growth in every quarter in 2022 and grew at an annual rate of 3.5%. Importantly, inflation in the euro zone dropped for the third month in a row to 8.5%. in January, from a high of 10.6 percent. in October.

Meanwhile, Chinese President Xi Jinping said in January that the world’s second-largest economy would grow 4.4% in 2022, better than expected but below the government’s target of 5.5%.

Yardeni forecast S&P 500 earnings per share this year of $225, slightly above FactSet’s average estimate of $224 for this year, and the consensus estimate for 2022 is for a 3% increase to $219 per share. Overweight Yardena recommends energy, finances. , industrial and materials in 2023 and maintaining market position in the area of information technology and healthcare.

While investors often decide whether a stock is in a bull market or a bear market, it is also possible that the market will bounce back throughout the year and not stray far from where it started.

Best Buy And Hold Trading Strategy 2023 — Trading Strategy Guides

Candice Tse, global director of advisory solutions at Goldman Sachs Asset Management, sees this as a likely scenario as the economy avoids a recession but revenue growth remains steady.

“The Fed can still do a soft landing,” Tse says. Based on this forecast, but expecting zero earnings growth from the $224 per share estimate in 2022, Tse projects the S&P 500 to end the year approximately 3% below the current index level of 4,117. At best, the S&P 500 will end the year 3 % increase.

Tse puts the probability of a recession at 25%, compared with the Wall Street consensus of 65%. It says that if a recession hits, it will change its outlook and the stock could fall by more than 20%.

The Fed will likely continue to raise the federal funds rate by an additional 0.25% to a range of 5-5.25% before pausing at each of its March and May meetings. “We don’t expect a quick turnaround,” he explains.

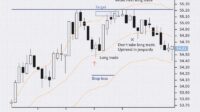

Swing Trading Patterns: How To Use The Best Chart Patterns For Swing Trading (plus An Easier, More Foolproof Strategy)

Threats to its prospects: Russia’s ongoing war with Ukraine, growing tension between the US and China, suspension of efforts to raise the US budget’s debt ceiling, and “longer high” inflation.

While financial conditions over the past decade have supported growth in U.S. stocks and values, particularly large technology companies, today’s environment is characterized by slower growth, rising interest rates and shrinking profit margins for non-U.S. companies. Focuses on equities as well as US fixed income assets, US Stocks and dividend paying options

“We are preparing for Europe,” he says, adding that the “green energy momentum” includes positive developments resulting from a milder-than-expected winter that has reduced demand and prices. “The risk of recession in Europe has decreased significantly.”

Europe will also be a big beneficiary of China’s resurgence, as the Asia-Pacific region generates 21% of European companies’ revenues. A weaker dollar will also have a positive impact.

Why Premium And Discount Is The Best Smart Money Strategy? Let’s Learn How To Trade!

Tse also believes valuations are working in favor of European shares. While they typically trade at a discount to U.S. stocks, the current 28% gap is significant, he says.

Keith Parker, head of U.S. equity strategy research at UBS, says the stock market situation will get worse before it gets better. According to UBS, the recession will begin in the second quarter and last until the end of the year. “Under these circumstances, stocks are low from here until mid-year.”

He worries that investors are misreading market dynamics and notes a “significant disconnect” between investor enthusiasm for stocks and economic fundamentals. This led to a mispricing of risk for US equities.

According to Parker, the market recovery was driven by easing financial conditions, as the 10-year Treasury yield fell to 3.4%, almost a full percentage point below its October high. Moreover, the inflation rate fell “more and faster” than expected. Employment data is strong and suggests consumers can remain resilient, which will lead to reduced concerns about consumer spending. China’s ability to recover and Europe’s ability to overcome the recession “have removed the worst and helped the markets,” Parker says.

Day Trading Guide For Today: Six Buy Or Sell Stocks For Wednesday —september 13

He said investors are overlooking the sharp decline and deterioration in key economic data, including a sharp decline in the ISM Services Purchasing Managers’ Index to 49.6 in December compared to 56.5 in November and a market forecast below 55. The services sector contracted for the first time from May 2020 due to the Covid-19 lockdown.

Parker also noted that retail sales were negative in December, with the largest monthly decline of the year occurring during the key holiday shopping season.

“It usually precedes a recession, and yet the market doesn’t price in a recession,” he says. “The setup is essentially a competition between inflation and monetary easing and the resulting impact on economic growth and profits. “History shows that earnings growth continues to deteriorate in the face of market volatility before financial conditions deteriorate significantly.”

At current levels, the market is trading at 18 times forward 2023 earnings estimates and around 17 times forward 2024 earnings, even as earnings estimates decline and recommendations rise. The market is at a bearish bottom

Top Trading Strategies For 2023!

Short term stock trading strategies, stock trading strategies that work, different stock trading strategies, best stock trading strategies, trading strategies, penny stock trading strategies, stock futures trading strategies, stock trading strategies, stock swing trading strategies, stock trading strategies pdf, basic stock trading strategies, stock option trading strategies.