Annual Multi-trip Insurance – We’re here to protect you from unexpected events while you focus on planning your trip.

Travel* aims to keep you safe – from booking your ticket to the journey itself. Thanks to this insurance, you can travel and forget about your worries.

Annual Multi-trip Insurance

Ready to apply? Complete the application in just 5 minutes. Ready to apply? Complete the application in just 5 minutes.

Should You Buy Single Trip Or Annual Multi Trip Travel Insurance?

The above information is for information purposes only and does not constitute an insurance contract. Detailed information regarding the conditions and exclusions of the insurance can be found in the insurance contract and will be sent to you by e-mail after accepting the application.

Before deciding to purchase a Product, you may seek advice from a qualified advisor. If you decide not to seek advice from a qualified advisor, you should carefully consider whether the product is suitable for you.

To find out more about this product, please contact us on 6222 7733 or send us an email with your inquiry for further processing.

This policy is protected by the Policyholder Protection Scheme administered by the Singapore Deposit Insurance Corporation (SDIC). Your policy’s protection is automatic and no further action is required on your part. For further information on the types of benefits covered by the scheme and the coverage limits, if applicable, please contact your insurer or visit the GIA or SDIC websites (www.gia.org.sg or www.sdic.org). .sg).

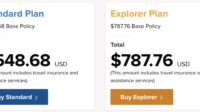

American Express Voyageguard Travel Insurance Standard Plans

If the same trip includes travel to several countries and different zones, the premium amount will depend on the furthest zone.

If the insured wishes to cancel the policy after successful payment, an administration fee of S$25 per insured person for an individual plan and S$25 for each family plan will be charged. In the case of an annual plan with multiple journeys, a short-term tariff applies, as stated in the contract. Amounts less than S$5 will not be refunded.

The eligible applicant must be a Singapore citizen or Singapore Permanent Resident residing in Singapore, or a foreign national holding a valid Singapore Employment Pass or Work Permit, or a Dependent Pass or Long-Term Residence Pass for the purpose of staying in Singapore.

The Family Plan covers you and/or your spouse with any number of children traveling together throughout your trip.

The Canadian Guide To Annual Multi Trip Travel Insurance

For an annual multi-trip family plan, your child must be accompanied by at least one insured adult on each trip during the insurance period.

“Child” means a wholly dependent child under the age of eighteen (18) or twenty-three (23) years of age who is enrolled full-time at an accredited university and is not married or employed at the time of commencement of the course specified in the insurance certificate and/or during the insurance period specified in the policy.

There is no age limit for a person applying for single trip insurance. However, some benefit limits are reduced for children and adults over the age of seventy (70).

For the Annual Multi-Trip Plan, the minimum and maximum enrollment ages at the time of purchase are twenty-one (21) and sixty-five (65) respectively. Insurance policy renewal is not guaranteed.

The Best Kept Secret Among Backpackers: A Multi Trip Annual Travel Insurance • Nomad Junkies

We strongly recommend that frequent travelers purchase annual multi-trip insurance as it is more cost-effective and convenient. The policy is issued for a period of one (1) year, and the person may make an unlimited number of trips to the selected travel region and the duration of each trip may not exceed ninety (90) days.

An annual multi-trip policy is now available to individuals and families. For an annual multi-trip family plan, your child must be accompanied by at least one insured adult on each trip during the insurance period.

Claims arising from a known event will not be covered unless you took out the policy before the known event was reported in the media or in travel advisories from the Ministry of Foreign Affairs (MFA) and the World Health Organization (WHO).

You must purchase the Travel option before leaving Singapore. If you end your trip after leaving Singapore, your insurance contract will expire, i.e. H. has no insurance.

Annual Trip Travel Insurance Singapore

After paying the premium, a copy of the insurance certificate will be sent to the e-mail address provided during registration. If you have provided your mobile number when applying, you will also receive an SMS (Short Message Service) informing you of the success of your online application.

Can I get a refund of my premium if I decide to cancel my insurance policy after activating my trip online?

In the case of an Individual Travel Plan, we will refund the premium paid less a minimum premium of USD 25 per insured person in the case of an Individual Travel Plan and USD 25 in the case of a Family Plan. Once you start your trip or make a claim under the issued policy, the premium will not be refunded. There are also no refunds for amounts less than S$5.

Annual multi-trip plans require at least thirty (30) days’ written notice. The premium will be refunded at the short term rates specified in the policy unless a claim is made before the policy is canceled.

Annual Multi Trip Travel Insurance: Saving You Time And Money

The refund of the insurance premium will be made to the same card with which the insurance premium was paid at the time of purchase.

You can contact us on 6222 7733 Monday to Thursday 8:45 a.m. to 5:45 p.m. and Friday 8:45 a.m. to 4:45 p.m. You can also email your request to personal-insurance@.

No, we do not offer one-way travel insurance. The trip must start and end in Singapore within the insurance period.

For a Single Travel Plan, coverage commences when you leave your place of residence or business in Singapore (whichever is later) to commence your journey, until you return to your place of residence or business in Singapore or until the expiry insurance certificate (whichever comes first) at the end of the trip.

Explorer Travel Insurance

You can call our 24-hour emergency hotline at 65-6222 7737 and our designated service provider will assist you.

You can submit your claim online or send your claim form and supporting documents to our claims processing agent:

All claims must be made within thirty-one (31) days of your policy expiring or your return to Singapore. You can make claims on behalf of other beneficiaries, provided all beneficiaries have the same policy number/certificate number, claim and accident date and benefits.

If you apply online, once your application is successfully submitted you will receive a confirmation with your application reference number sent to your registered email address.

Annual Multi Trip Travel Insurance

If you submit your claim by mail, you will receive confirmation to your registered email address within three (3) business days of receiving your claim form.

To protect yourself or your family financially in the event of an accident. This insurance covers you 24 hours a day, everywhere.

Designed to protect domestic workers while employed. The benefits meet the requirements of the Ministry of Labor.

Designed to protect your residential assets from unforeseen and sudden physical loss or damage other than those expressly excluded.

Annual Travel Insurance

We use cookies to improve and personalize your browsing experience. By continuing to browse our website, you agree to our cookie policy. When it comes to traveling abroad, especially long distance, for business or even educational purposes, ensuring health and safety is often one of the top priorities when preparing for travel. Travel insurance is probably the first thing that comes to mind, but there is also international health insurance that may protect you.

While these two insurance policies may seem similar, the insurance they offer differs in many ways. If you don’t know which option is better for you and your travel companion, here we will explain the differences and learn how to choose the most suitable option.

When considering two different categories of insurance, there are several factors to consider, including:

If the main purpose of your trip is to go on a long, one-time holiday or permanently move to another country for work or study, international health insurance will be more beneficial to you than travel insurance because it will provide you with comprehensive health care insurance for a period longer than 90 days .

First Travel Insurance

Additionally, you can stay abroad for a longer period of time without worrying about medical costs. For short trips of less than 90 days, travel insurance may be sufficient as such comprehensive insurance is not needed as the length of stay is much shorter.

As you spend more time in different countries, more comprehensive health insurance is required. Therefore, it is better to buy international health insurance than just travel insurance. Let’s assume you are an expat traveling

Annual multi trip policy, annual multi trip travel insurance for seniors, allianz annual multi trip travel insurance, travel insurance annual multi trip, multi trip annual insurance, covermore annual multi trip, annual multi trip travel insurance 90 days, what is annual multi trip travel insurance, best annual multi trip travel insurance, annual multi trip international travel insurance, annual multi trip domestic travel insurance, annual multi trip travel insurance 60 days.