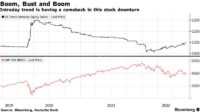

Top Dividend-paying Stocks – 2023 is off to a great start, with the SPDR S&P 500 Trust ETF ( SPY ) kicking off the new year with a 6.29% gain in January. Vanguard’s High Dividend Yield ETF ( VYM ) also gained 2.37% last month. My watchlist jumped out of the gate a little quicker, posting an 8.50% return for January.

The final performance figures for 2022 were pretty grim. SPY ended the year down 18.16%, my watchlist was down 11.95% and VYM almost stayed green but ended up with a loss of 0.45%. While VYM is not known to outperform SPY, the fund has enjoyed a period of better than average performance. VYM’s five-month winning streak against the SPY was finally snapped in January.

Top Dividend-paying Stocks

Comparing the combined returns for my monthly watchlist with VYM and SPY can be a little misleading. My watchlists aim to showcase the best quality and value opportunities that offer attractive dividend yields throughout each month. The more meaningful outcome of these selections can be better assessed through a long-term buy-and-hold strategy.

Top 3 Highest Dividend Paying Stocks In Buffett’s Portfolio

While it’s never fun to see your investments go down in value if you’re a long-term investor, they’re mostly paper losses. A sharp decline in quality high yield stocks should be viewed as an opportunity to increase the dollar cost averaging of the position.

The main purpose of a high dividend yield portfolio is not to outperform the general market, but to create a passive income stream that is relatively safe, reliable and can grow in the future. The top 10 stocks on my February 2023 watch list offer a dividend yield of 4.23%, more than double the dividend yield of the S&P 500. These 10 stocks also raised their dividends with a historical rate of 12.88% annually in the last period. five years. Collectively, all 10 stocks appear to be currently potentially undervalued by about 21% based on dividend yield theory.

The best way to build a strong, high-yielding dividend portfolio is with a buy-and-hold strategy. This strategy forces you to think about the stocks you choose to invest your capital in, as the plan is to hold positions indefinitely. Taking this long-term approach, focusing on potentially undervalued stocks, allows investors to generate alpha through capital appreciation. While this may not suit every position, diversifying your high-yield portfolio across 20 or more single stocks will increase your chances of picking up shares of certain stocks when they trade at bargain prices. The beauty of long-term prospects is time; you can sit back and wait for valuations to return to historical norms while collecting generous passive income.

In creating the high-yield watchlist, I had four areas of interest to focus on: core criteria, safety, quality, and stability. First, the basic criteria aims to narrow the list of stocks to those that pay a dividend, offer a yield above 2.75% and trade on the NYSE and NASDAQ. The next set of criteria focuses on safety, as it is a key part of a high-yield investment strategy. The filter excludes companies with payout ratios above 100% and companies with negative five-year dividend growth rates. Another level of security may be associated with larger companies; therefore, the watchlist is restricted to stocks with a market capitalization of at least $10 billion. The next set of criteria was narrowing down the list to include higher quality companies.

How Much Money Can I Earn By Investing In Dividend Income Tech Stocks?

The three quality filters are: wide or narrow Morningstar trench, standard or exemplary Morningstar management, and an S&P quality rating of B+ or higher. Morningstar’s moat rating represents a company’s sustainable competitive advantage, the main difference between a wide moat and a narrow moat is the length of time Morningstar expects this advantage to last. Broad channel companies are expected to maintain their advantage over the next 20 years, while narrow channel companies are expected to maintain their advantage over the next 10 years. Morningstar Management rates a company’s management team against its equity.

The S&P Quality Score evaluates a company’s earnings and dividend history. A grade of B+ or higher is associated with above average jobs. The last set of criteria focuses on the stability of the company’s business and bottom line growth. The filter removes companies with a negative five-year revenue or earnings per share growth rate. I believe that a company that is growing both top and bottom has the ability to deliver growth to its investors in the future.

All stocks that pass the initial screening criteria (41 this month) are then ranked by quality and valuation. In addition, I rank the stocks in descending order based on the best combination of quality and value and select the top 10 stocks that are expected to have long-term annualized returns of at least 12%. Because forecasts of future earnings growth are constantly being revised downward, I had to lower my expected return threshold from 12% to 10% to find this month’s top 10 stocks. Only 2 out of 10 picks had an estimated rate of return that exceeded 12%.

This is the watchlist for February 2023. There are four changes from last month: Bank of Montreal (BMO), Comcast (CMCSA), Intel (INTC) and Truist Financial (TFC) exit and are replaced by Fastenal (FAST), Morgan Stanley (MS), Restaurant Brands (QSR), and United Parcel (UPS). The data shown in the image below refer to 31.1.23.

Best Highest Dividend Paying Stocks In India

The expected rate of return shown in the last column is calculated by taking the current dividend yield plus the fair value yield over the next 5 years and the discounted long-term earnings forecast.

Please note that my return predictions are based on assumptions and should be viewed as such. I don’t expect these 10 companies to make the expected returns. What I expect is that these 10 companies have the potential to deliver better returns over the next 5 years compared to the 31 high yield stocks that passed my initial filters but ranked worse in what concerns quality and assessment.

The top 10 list for January performed very well against the benchmarks they track, with the selected stocks collectively returning 8.50% last month. This was 6.13% better than VYM and 2.21% better than SPY. The top 10 list got off to a great start this year and will look to make up for a not-so-great showing in 2022. Since its inception, which was 27 months ago, the watchlist trailed VYM by 3.19%, but outperformed SPY by 3.19%. 4, 41 percent.

I don’t expect this watchlist to beat VYM or SPY every month. However, I believe that a buy-and-hold investment approach that capitalizes on the stocks represented on this watchlist will generate long-term alpha relative to the broad market. I also have a personal target rate of return of 12%, which I believe will be achieved by this watchlist if measured over long periods of time.

Top Dividend Stocks With Stable, Growing Yields: Morgan Stanley

After January, the watchlist’s long-term annual rate of return improved from 12.67% to 16.31%. The 2 years of history I’ve measured so far is a long time, but I’d really like to have 5 or 10 years of results before I start making more judgments.

PFG gained 10.28% in January and remains well over 100%, retaining its top spot. GD fell 5.5% but retained second place. BMO gained 12.27% last month to come in third. TD added 8.08% in January and is back in the top 5. CVS dropped 4.68% and falls to #5. MRK lost 3.19% last month and is in the top 5.

In total, there have been 68 unique high-yield stocks that have appeared on the top 10 list over the past 2 years. Of these 68 unique stocks, 56 have had a positive total return since their first appearance in the top 10, up 5 from a month ago. The average total return for these 56 stocks is 35.66% (32.96% last month). The average loss for the 12 stocks with negative total returns is -16.52% (-17.87% last month). Here are all 68 stocks, their total return since inception and the number of months since they first appeared in the top 10.

S’pore Stocks Top For Dividends In Asia, Business News

Dividend paying stocks, top 30 dividend paying stocks, dividend paying penny stocks, top paying dividend stocks, dividend paying gold stocks, canadian dividend paying stocks, top 50 dividend paying stocks, top 10 dividend paying stocks, dividend paying stocks list, dividend paying utility stocks, buy dividend paying stocks, monthly dividend paying stocks.