Tech Stock Investment Guide – The project comes from the StocksWizard team, which was awarded the Innovation Award at the PolarDB Global Hackathon 2023.

Stock Market Trading Simulator (StockWizards) provides a simulation platform intended to help people understand how the stock market works. However, the program has many problems that make it difficult for users to make uninformed trading decisions, such as inaccurate price data, a limited number of stocks to choose from, technical problems, and insufficient risk management tools. Addressing these issues will improve the user experience and make the simulator more useful in educating people about the stock market. Stock Wizard is a platform designed to help users understand the stock market and enjoy a simulated stock trading experience.

Tech Stock Investment Guide

It aims to improve public knowledge on stocks and investments while avoiding fraudulent applications. The simulator helps traders understand the mechanics of stock trading and create better trading strategies.

Stock Market Experts: Your Guide To Investment Decisions By Chaitali Shah

This program provides a practical solution for traders who want to understand the mechanics of stock market trading and create better trading strategies.

Traders and investors can use the simulator to experiment with different trading strategies and investment portfolios. They can test their ideas without risking real money, which protects them from potential losses in the real stock market.

Overall, Stocks Wizard helps traders and investors improve their knowledge, skills and confidence in the stock market, which ultimately leads to more successful and profitable trading and investment strategies.

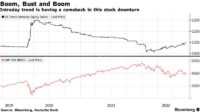

We have a regular team in developing the StockWizard project, consisting of Fauzi Lingo, myself as Backend & Kafka Developer, Rizki Fathurrija as Backend Developer, Muhammad Fahryan as Technical Writer and Rangga Sayaputra and Bakti Parningotan Marban as Frontend Developers. Many investors analyze stocks based on fundamentals such as earnings, valuation or industry trends, but fundamentals are not always reflected in market prices. Technical analysis attempts to predict price movements by examining historical data, particularly price and volume.

Day Trading Guide For Today: 6 Stocks To Buy Or Sell On Monday — 13th March

It helps traders and investors navigate the difference between intrinsic value and market price by using techniques such as statistical analysis and behavioral economics. Technical analysis guides traders on what is most likely to happen when given past information. Most investors use technical and fundamental analysis to make decisions.

Generally, there are two different ways to approach technical analysis: the top-down approach and the bottom-up approach. Often, short-term traders take a top-down approach and long-term investors take a bottom-up approach. Additionally, there are five basic steps to getting started with technical analysis.

A top-down approach is a macroeconomic analysis that looks at the economy as a whole before focusing on individual securities. A trader focuses first on the economy, then on the sector, and then on the company in the case of shares. Traders who use this approach focus on short-term gains as opposed to long-term valuation. For example, a trader may be interested in stocks that have broken out of their 50-day moving average as a buying opportunity.

A bottom-up approach focuses on individual actions as opposed to a macroeconomic view. It basically involves analyzing a stock that looks interesting for potential entry and exit points. For example, an investor may find a valuable stock in a downtrend and use technical analysis to identify a specific entry point when the stock declines. They look for value in their decisions and consider keeping a long-term perspective on their businesses.

How To Trade Stocks Online — Stock Trading Guide For Beginners

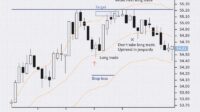

In addition to these considerations, different types of traders may prefer to use different forms of technical analysis. Day traders may use simple trend lines and volume indicators to make decisions, while swing or position traders may prefer chart patterns and technical indicators. Traders who develop automated algorithms have completely different needs, using a combination of volume indicators and technical indicators for their decision making.

The first step is to identify a strategy or develop a business system. For example, a novice trader may decide to follow a crossover moving average strategy, where two moving averages (50-day and 200-day) are followed on the price movement of a particular stock.

For this strategy, if the short-term 50-day moving average is above the long-term 200-day moving average, it indicates a price trend and generates a buy signal. The opposite is true for a sell signal.

Not all stocks or securities are suitable for the above strategy, it is suitable for highly liquid and volatile stocks instead of liquid or stable stocks. Different stocks or contracts may also require different parameter choices—in this case, different moving averages, such as the 15-day and 50-day moving averages.

A Beginner’s Trading Guide To The Stock Market

Find the right trading account that supports your chosen security type (eg, common stocks, penny stocks, futures, options, etc.). It should provide the necessary functionality to track and monitor selected technical indicators while keeping costs low to avoid eating into profits. For the above strategy, the basic and moving average account works on the candlestick chart.

Traders may require different levels of activity depending on their strategy. For example, day traders need a margin account that provides access to Level II quotes and market maker visibility. But for our example above, the basic account is preferred as the lower cost option.

There may be other features required to increase performance. Some traders may need mobile alerts or access to trade on the go, while others may use automated trading systems to execute trades on their behalf.

Trading can be difficult, which means it’s important to do your homework beyond the points mentioned above. Some other key considerations:

Is Investing In Stocks Haram Or Halal? Halal Investment Guide

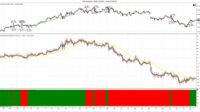

Most novice technical analysts focus on a few indicators such as moving averages, relative strength indicator and MACD indicator. These parameters help identify whether an asset is oversold or overbought and therefore likely to face a reversal.

There are many ways to learn technical analysis, including books and online courses such as the Academy. Once you have a solid foundation, you can start testing your trading skills through paper trading before investing real money.

Although it is possible to make money from technical analysis, using profitable charting strategies requires a high level of skill and sophistication. Individual traders should exercise strong self-control and avoid emotional trading. They also need enough initial capital so they don’t go broke after a few bad deals.

Many investors leverage fundamental and technical analysis when making investment decisions because technical analysis helps fill in knowledge gaps. By developing an understanding of technical analysis, traders and investors can improve their long-term risk-adjusted returns, but it’s important to understand and practice these techniques before committing real capital to avoid costly mistakes.

Beginner’s Guide To Stock Trading

Authors are encouraged to use primary sources to support their work. These include white papers, government data, original reports and interviews with industry experts. We also refer to original research from other reputable publishers when appropriate. You can learn more about the standards we follow to create accurate, unbiased content in our editorial policy. Our mandate is to write about investing in emerging and disruptive technologies. Over the years, we’ve noticed that many early-stage investors are attracted to our content because they [

] action. We can help with that. We have spent the past decade researching and investing in disruptive technology stocks. You don’t pay us any fees and we have no ulterior motives: we want to share with you what our advanced finance degrees didn’t teach us – that getting filthy rich is a long and boring process.

We don’t have a crystal ball, but we share a proven methodology with you so you understand how we arrive at every investment decision. More importantly, it will teach you how to apply the same approach to making smarter investment decisions on your own.

But before you dive into the high-risk, high-reward world of high-tech stocks you need to pull over. We’ll walk you through some of the basics – lessons learned from the mistakes that most beginner investors often make. We have created this comprehensive beginner’s guide to buying stocks for new investors who are determined to find the “best stocks to invest in”.

Stock Market Secrets: My Smartest Investment Tips After 16 Years Of Reporting

Hundreds of personal finance blogs will tell you how to live below your means, pay off all debt as a priority, and save money with every paycheck. We explain all this and assume that you are smart enough to accumulate the money you want to invest in shares. We also assume that you are familiar with asset allocation, meaning that you diversify your wealth across multiple asset classes. (

) The term “asset class” refers to popular investment types such as real estate, stocks, and bonds. Other obscure asset classes:

Today we will only talk about actions. We begin with what we refer to as “core holdings.” Before you even start thinking about picking stocks, the bulk of your capital should be in core holdings that represent a diversified portfolio of stocks. Everyone has a different idea of what “majority” means, so let’s say 80% of your wealth should be in assets that let you sleep well at night. A little about that. First, let’s clear up some misconceptions

Tech investment firms, tech investment, best tech investment banks, clean tech investment, tech investment companies, green tech investment, tech investment fund, tech investment banking, top tech investment banks, tech startup investment, tech boutique investment banks, tech investment opportunities.