Car Insurance Deductible Tips – Today is the day we beat your debt. MMI can put you on the path to debt-free dating. Let’s do it together.

Are you facing bankruptcy? You may have more options than you think. Our consultants will help you find the best way.

Car Insurance Deductible Tips

Use it wisely Credit cards open all sorts of convenient doors. But if used unwisely, credit cards can also put you in a financial hole.

How Do Insurance Deductibles Work?

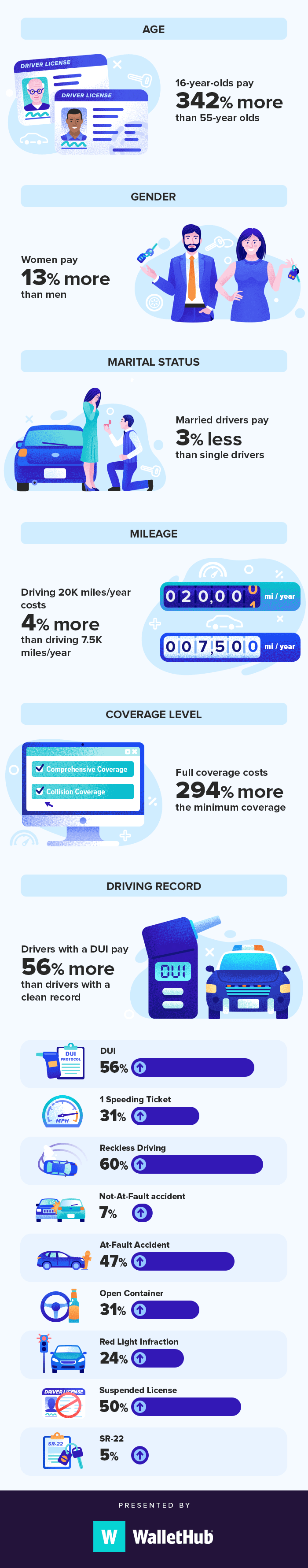

Car insurance is probably one of the biggest budget items you have. Especially if you have multiple cars. There are many factors that determine the price: Where you live. How long you drive Purpose of driving (work or personal) Driving history Your credit history Type of car you drive etc.

But you can’t go without insurance. If you want to drive, you must have one. Otherwise, you may be fined and lose your driver’s license. Not to mention the costs you would have to bear if you were actually involved in an accident. Car insurance is important.

Most Americans drive today. In fact, 95 percent have a car. This is only 60 percent of 1940, and 85 percent of us use those cars to get to work.

If you’re ready to save money on car insurance, you’ve come to the right place. There are several ways to reduce these costs, starting with these two quick options:

Best Car Insurance With A $500 Deductible

There may be discounts you don’t know about. For example, many professional associations offer discount codes for useful services and products to their members. Make a list of all associations you belong to, including car insurance. This includes industry associations, online groups, and even alumni associations. Then call the insurance company and complete the transaction with them. They can look for different associations. by name to find out if there are any partner discounts.

Getting on the phone with your insurance company takes time. Instead of trying to email or chat directly with them. Ask about any discounts. they recommend you to be eligible for You may be surprised at what you learn.

Both of these options are quick fixes to lower your insurance premiums immediately. But it takes a little research and hard work to save a lot of money. You should be willing to take the time to consider your options, but this is a good time to significantly lower your premiums.

First, make sure you have the right coverage for your needs. Insurance companies want to provide as much coverage as possible. That’s how they earn money. But coverage is not always necessary. The truth is that most accidents involve small wing benders. And you may be overprotective.

How Do Deductibles Affect Car Insurance Premiums?

There are many types of coverage to choose from. It’s important to understand these and make sure you have the right dosage for your lifestyle. There are different types of coverage here. You may also like:

Liability coverage – Covers costs if you are at fault for any damage. This does not cover injuries to anyone in your vehicle or other vehicles.

Bodily Injury Liability (BIL) Coverage – Covers the medical expenses of those injured in an accident for which you are at fault. This coverage is often described as 20/50 or 100/300. Basically, a 20/50 policy pays up to $20,000 for injuries to one person and up to $50,000 for injuries to everyone involved.

Property Damage Liability Coverage – Covers damage to another vehicle if the accident is your fault. It is sometimes shown as the third number in the equation in your policy information. For example, a 20/50/10 policy covers up to $20,000 for one person injured, $50,000 for each person injured, and $10,000 for vehicle damage. If you are at fault for the accident.

Buying Car Insurance Online: How To Do It (2023 Tips)

When considering your liability coverage needs, it’s important to know when your coverage is exceeded. You will be responsible for the remaining costs and will have to pay this out of your own pocket. If you are involved in a serious accident for which you are found to be at fault. Your assets and credit may be at risk. A good rule of thumb is to make sure your coverage exceeds or at least equals all your assets, including your home, car, investments, savings and any other assets you may have.

Personal Injury Protection (PIP) – This coverage covers medical expenses for you and your passengers. Accident-related injuries If these injuries cause you to lose your job, this bonus may cover lost wages.

If You Have Adequate Health Insurance and Disability Coverage You may be fined the minimum coverage amount required by the state for PIP if you do not have qualifying health insurance or disability coverage. You may want to add PIP because your medical bills may be much higher than your property damage.

Uninsured / Underinsured Auto Insurance – If you have been in an accident caused by another person and they are uninsured or have insufficient insurance. This will help you take care of your expenses. This coverage is required in most states and is usually relatively inexpensive. If you are involved in a major accident, this can make a big difference. This covers medical expenses that your health insurance may not cover. This coverage should be equivalent to BIL coverage.

When To Increase Your Auto Liability Limits

Collision Coverage – Covers repairs to your vehicle after an accident. Your coverage for this can vary depending on the type of car you have. For example, BMW parts will be more expensive than Honda parts, so consider the potential costs when considering this. How much collision coverage should you have? miscellaneous expenses Anything that exceeds your coverage limit will be your responsibility.

Comprehensive coverage – Covers the costs of theft or damage to your vehicle in addition to an accident. This will help you trade in a car worth the same or less than your own car.

It’s important to remember that collision coverage and comprehensive coverage only cover what your car is worth in today’s market. Not what you paid for Or you owe on that car. Your car starts depreciating as soon as it leaves the parking lot and continues to depreciate over time. Your car will deteriorate over time. You can cancel these coverages and use them to save money for your next car instead.

Not sure how much your car is worth today? You can do a quick search on the Kelly Blue Book website by simply clicking on “My Car Value” and entering the make, model, mileage and all the features. and where you live now It will tell you what your car is worth both for trade in and for sale.

Safety Tips For Your Teen Driver

Take a close look at your auto insurance policy to see how much you’ll pay for accident insurance and comprehensive coverage each year. If these numbers add up to more than 10 percent of your potential payment (your deductible on the value of your car.) it’s time to drop these numbers from your coverage.

This research can take a lot of time. But you can save more money. Remember that every positive financial change you enjoy both immediately and over time will add up every month. And it makes up some incredibly useful space in your budget.

Now we’ve looked at some immediate and profound ways to save on your current policy. There is another option to investigate. Switch insurance companies entirely.

Less than 25 percent of all drivers take the time to regularly purchase insurance policies. But almost half of those who shopped switched to another company.

What Is A Car Insurance Deductible?

Different Insurance Companies How can I get the same insurance on the same car in the same state at a lower price? Easy going. Not all insurance companies measure risk the same way. So you may be high risk in one company and medium risk in another. Don’t assume you’ll pay the same rate no matter which company you choose. A previous accident history may cost you more with one company than another. Hometown living may be more expensive with one company than with another. Your credit rating may be reviewed with the company. But not with another company. Research and find out what other companies are doing. Billing from another company takes time.

Consumers rarely have time to do homework and shop. Because it’s not easy to do. According to a NerdWallet survey, “88 percent of drivers are discouraged from buying car insurance. Because it takes a lot of time Difficult to compare prices or invasion of privacy.’

But the

Low deductible car insurance, usaa car insurance deductible, car rental deductible insurance, car insurance deductible explained, 1000 dollar deductible car insurance, car insurance deductible meaning, car insurance comprehensive deductible, $500 deductible car insurance, best deductible for car insurance, car insurance deductible calculator, deductible car insurance, $0 deductible car insurance.