Car Insurance Claim Process – In the UK, car insurance is a legal requirement for anyone who wants to drive on public roads. It is designed to protect drivers from financial losses related to accidents and other types of damage to their vehicles. Auto insurance policies generally cover damage to the vehicle and its occupants, including third-party property damage, medical expenses, and personal injury expenses. Different providers offer insurance at different rates. Here’s how to get a car insurance policy in the UK.

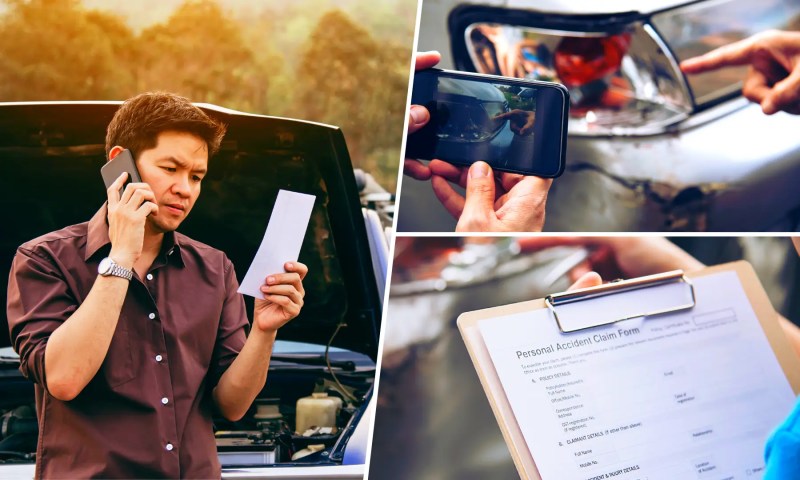

Making a car insurance claim in the UK is the process by which an individual asks their car insurance provider for compensation for damage or loss caused by an accident. A claim is usually filed after the person reports the accident to the police and submits the insurance policy to the insurer. The insurer reviews the claim and decides whether or not to pay. Depending on the individual’s policy, excess and other terms and conditions may be paid before the claim is accepted.

Car Insurance Claim Process

In the UK, a car insurance claim must be made within 24 hours of the accident and you may be deemed to have accepted the accident. This is the deadline for filing auto insurance claims. The claim must be submitted to the insurer, who will investigate the problem and determine who is responsible. You must provide evidence such as photographs, witness statements and a police report. The insurer assesses the claim through a motor insurance adjuster and pays the premiums.

Insurance Claim Singapore

Auto insurance adjusters are professionals who investigate and evaluate claims made on auto insurance policies. They assess the extent of the damage or loss, assess the value of the claim, and then negotiate a settlement with the plaintiff based on their findings. Adjusters can work for insurance companies or work independently. It also gives advice on how to prevent similar diseases in the future.

The location of the accident is an important aspect of a car insurance claim in the UK as it can reveal the circumstances surrounding the accident. This helps determine who is at fault, the extent of the damage and the potential cost of repairs or replacements. An understanding of the accident site will help the insurance company determine the status of the claim, allowing them to accurately assess the risk.

When you make a car insurance claim in the UK, you can expect to be paid the sum insured of your policy. You are also entitled to other benefits such as legal fees and car donation. Depending on the circumstances of the claim, you may also be able to claim for damages to your vehicle or personal belongings that were damaged in the accident.

Auto insurance claims can be disputed by insurers. Car insurance claims disputes in the UK can arise for many reasons. Common causes of conflict are listed below.

Drive Blockchain Technology Into Usage Based Insurance (ubi)

To claim car insurance under temporary car insurance, you need to contact the insurer and give him the necessary information about the accident. To make a short-term car insurance claim after an accident, you should call the 24/7 claims helpline. You must act as soon as possible within twenty-four hours of the incident. The 24-hour complaint helpline should be called within one hour.

Get to a safe place immediately after the accident. Stop only in a safe place. Improper braking puts you and passengers at risk.

In the event of an accident, it’s a good idea to make notes of various situations that will be useful in a police investigation. This makes handling complaints easier. Physical evidence at the accident scene is also important. If video evidence can be obtained, this can be very helpful in making a temporary insurance claim. This sign must be an image, but if an image is not possible, the sign is a sketch. If photographic evidence is used, it should clearly show the location of the vehicles and the extent of the damage to the vehicle. The sketch should show the final position and directions of the vehicle – a physical photo will not be useful for damaged vehicles.

If someone asks you for your information, you must provide your personal information. You can ask someone for their opinion if you can show a good reason. Any person or persons affected by an accident have the right to call the Emergency Helpline 24/7. By posting a phone number, you can send information to reach them. This will help you to repair and provide a courtesy car. A car or a car can be given if the circumstances of the accident warrant it.

Do’s And Don’ts Of Car Claim Insurance Process

To make a temporary car insurance claim, you need to contact the insurer and provide them with the necessary information about the problem. This includes a detailed description of the event, date and time of the event, location and other relevant information. The policy number and a document confirming the ownership of the vehicle must also be provided. Your insurer will assess the claim and determine if it is valid. If the insurer finds that the claim is valid, it will either offer you a settlement or an alternative payment.

Police reports are important documents for short-term auto insurance claims because they record the details of the accident, including important details such as the date, time, location and names of the people involved. A police report can provide information about witnesses and other parties involved in the accident, which can help the insurance company investigate the claim. Information obtained from police reports can be used as evidence in court proceedings, and will help to accurately report what happened. Police reports can also help provide clarification when investigating an incident.

A police report is an important document when filing a car insurance claim because it details the accident and confirms what happened. It also helps to establish liability, which is important in determining who is responsible for the costs associated with an accident. In addition, the police report contains a record of the crime that occurred and can determine who is at fault.

Having physical documentation for a car insurance claim is important because it proves that the claim is valid and that it was a damage or accident. Documents can also provide information necessary to determine liability and assess damages. Documents may include photographs, police reports, medical records, estimates, and other evidence to support the claim.

Steps For Making A Car Insurance Claim

It’s difficult to give an accurate answer on how long it takes to process a car insurance claim. The amount of time it takes to process depends on many factors.

The processing time for an auto insurance claim for a short term auto insurance policy depends on the type of claim, the details of the claim and the individual insurance provider. The time it takes to process a car insurance claim varies depending on the extent of the damage and the complexity of the claim. How long it takes to process a car insurance claim for temporary car insurance depends on a number of factors. These factors include the complexity of the claim, the insurance company’s internal processing time, and the availability of required documents. Generally, it can take from a few days to a few weeks to be fully processed and resolved.

No, processing a car insurance claim is not difficult. The process for making a claim on temporary car insurance is the same as making a claim on long-term car insurance. Making a temporary insurance claim depends on the company you work for. Some insurance companies have an easy process for filing a short term car insurance claim, while others require additional documentation and paperwork. Finally, the task should not be too difficult, but it may take some time to complete.

Most car insurance companies have an online form that you can fill out to file a claim. This means providing required information such as policy number, vehicle details and incident description. The insurance company will review your claim and determine if it is eligible for coverage.

Simplifying The Tata Aig Car Insurance Claim Process: A Comprehensive Guide

The ease of filing a short term auto insurance claim also depends on the complexity of the claim. In general, the more information you can provide and the better your hypothesis, the

Insurance company claim process, insurance claim process pdf, home insurance claim process, health insurance claim process, property insurance claim process, stolen car insurance claim process, roof insurance claim process, insurance claim payment process, flood insurance claim process, insurance claim process, car theft insurance claim process, life insurance claim process.