Best Long-term Stock Investments – Here are the best Philippine stocks to buy today and in 2023 if you are a long-term investment or if you want to grow your capital for at least five years.

We have selected these stocks based on profitability, high liquidity, stable financial situation, sustainability and long-term outlook.

Best Long-term Stock Investments

According to the World Bank, the Philippine economy is expected to grow by 6% in 2023. Business and the economy are expected to slow down in 2023, but there are more opportunities for investors and traders.

New Year, New Savings Plan: 5 Smart Tips For Beginning Investors

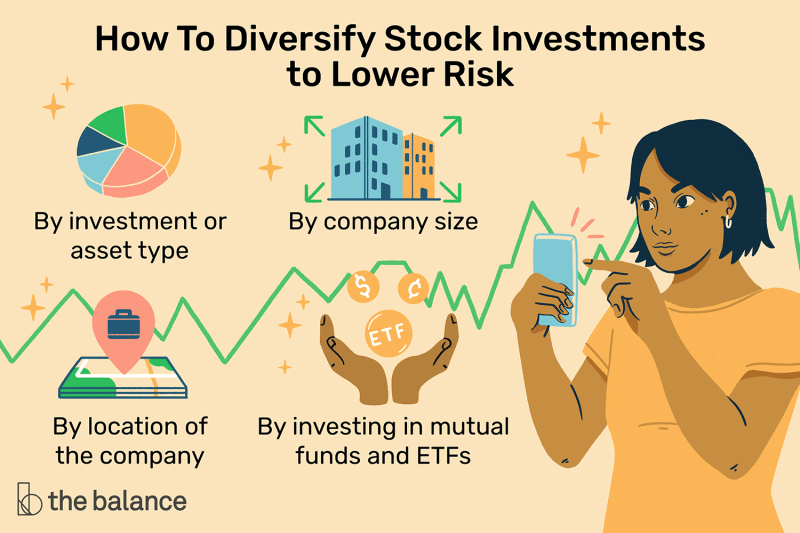

Long-term investing is one of the best ways to invest. It occurs when investors buy shares in blue-chip companies or companies with steady earnings potential and hold the shares for at least five years (longer is usually better).

SM Investments (Stock Code: SM) includes all business segments of the SM group of companies, offering retail, real estate, banking and equity investments. SM Investments is so awesome. It has a market capitalization of over P1 trillion, making it the largest company in the Philippine stock market.

If I want to hold one stock until retirement, it’s SM. Three of its companies – SMIC, SMPH, BDO – already account for more than 30% of the value of the Philippine stock market index. The company has excellent basic information and an impressive result. It also rewards generous dividends. Investors looking for long-term profitable growth should invest in SM shares.

Ayala Corporation (stock code: AC) is one of the largest conglomerates in the Philippines. This giant company is the parent company of well-known Philippine companies including BPI, Globe Telecom, Ayala Land and AC Energy and Infrastructure. It currently has a market capitalization of over £381 billion. Why should you invest in Ayala Corporation stock?

Best Stock Picking Services For 2023: Money Crashers

Because it is one of the best blue-chip companies in the Philippines and regularly pays dividends to its shareholders. AC stock is one of the largest stocks listed on the PSEI, the Philippine Stock Exchange’s benchmark index. Consequently, most mutual funds and equity funds that track the PSEI allocate their capital to AC stocks. 3. SM Prime Holdings (SMPH)

SMPH is the property developer division of SM Group. It is one of the largest integrated real estate developers in Southeast Asia. The company has 78 shopping centers in the Philippines and 7 in China. In addition, SMPH develops and manages residential properties, commercial and office buildings, hotels and congress centers.

SMPH is PSE’s largest real estate company measured by market capitalization (trillions). Therefore, it is empowered to use sufficient funds to continue expanding and innovating its business and real estate projects in the future. SMPH also has a strong foundation. Its consolidated net profit of PHP30.1 billion in FY22 and regular dividends to shareholders also boost investor confidence. 4. Ayala Land, Inc. (ALI)

Ayala Land, Inc. (Stock Code: ALI) is one of the most diversified real estate developers in the Philippines. With a market capitalization of P429 billion, ALI is one of the largest listed companies in the Philippines right now and one of the best stocks in the Philippines right now. Why should you invest in Ayala Land shares?

Best Stock Picking Services For October 2023

Because Ayala Land is one of the leaders in the real estate industry. ALI has a solid balance sheet. Its fortune is constantly growing. The company’s proven track record is an important factor for long-term investors to hold onto these stocks for about ten years. It is also good to note that ALI also pays a dividend.

International Container Terminal Services (Stock Code: ICT) is the number one terminal operator in the Philippines. ICT has extensive port facilities in 20 countries in the Asia-Pacific region, Europe, the Middle East, Africa and the Americas. ICT is definitely one of the best Philippine stocks in 2023.

Because it is a unique business and is the only terminal operator industry among the largest stocks in the Philippine market. Therefore, the competition (in the industry) is very low. ICT has a healthy financial and promising outlook. We believe that terminal expansion and post-pandemic port facilities will further increase ICT revenues in 2023 and beyond. 6. Jollibee Foods Corporation (JFC)

Jollibee Foods Corporation (stock code: JFC) is the largest food chain in the Philippines. It is currently expanding its food franchise business around the world. JFC also has subsidiaries for famous food chain brands such as Chowking, Red Ribbon, Mang Inasal, Greenwich, Burger King and many more. Why should you invest in Jollibee stock?

This Chart Shows Why Investors Should Never Try To Time The Stock Market

Because you want to allocate some of your investment funds to the food industry and JFC is a leading leader in the food chain listed on the Philippine Stock Exchange.

Historically speaking, JFC shares are still on the rise. Although the pandemic caused the stock to fall sharply, it is an excellent opportunity to buy before it reaches its maximum again.

JG Summit (stock code: JGS) is the holding company of Gokongwei Group. JGS is one of the largest and most diverse conglomerates in the Philippines. Its business includes prominent companies such as Cebu Pacific, Universal Robina Corporation, Robinsons Land Corporation, Robinsons Bank and JG Summit Petrochemicals. Why should you invest in JGS shares?

Because JGS is the parent company of many companies operating in the Philippines. By investing in JGS shares, you can diversify and gain exposure to its business segments. JGS is also one of the largest companies listed in the PSE index. Holding companies like JGS are one of the best stocks to buy in the Philippines. 8. Alliance Global (AGI)

Intraday & Long Term Investments In Stock Market Based On Zodiac Signs

Alliance Global (Stock Code: AGI) is a global Filipino conglomerate with interests in food, beverage, real estate, tourism, entertainment, gaming, infrastructure and fast food businesses. AGI has a market capitalization of more than 105 billion dollars and is listed on the PSE index. Why should you invest in AGI shares?

Because it’s a great holding company that owns McDonald’s franchises in the country. It also has world-class subsidiaries such as Megaworld, Emperador, Travelers International and Infracorp.

BDO is the number one bank in the Philippines in terms of assets, capital, deposits, loans and receivables. The company grew so much that it reached a market capitalization of £733 billion. BDO reported net income of PHP57.1 billion in 2022 and increased its quarterly cash dividend. Why should you invest in BDO shares?

Being the largest and largest bank in the country with 1,434 branches across the country, BDO can easily find and increase customers. Likewise, the company continues to increase its turnover every year. BDO is one of the best stocks to buy in the long term if you want to invest in the financial sector and receive regular dividends. 10. Aboitiz Equity Venture (AEV)

How To Buy Stocks In Singapore: 6 Steps To Begin Investing In Shares

Aboitiz Equity Venture (stock code: AEV) is one of the best managed conglomerates in the Philippines. Its core business is electricity, food, infrastructure, real estate, banking and financial services. Why should you invest in AEV’s shares?

Because it is advantageous to invest in holding companies because you are already diversified into many types of business. AEV owns Aboitiz Power, Unionbank Philippines, Pilmico Foods Corp., Aboitiz Land, Aboitiz InfraCapital and many other well-placed businesses.

BPI is the first bank in the Philippines and now one of the largest banks in the country. Ayala Corporation has a majority stake in BPI. The company is one of the largest stocks listed on the Philippine Stock Exchange Index. Why should you invest in BPI shares?

Because BPI has been there since 1851, during the Spanish era. It has been one of the best banks in the country since then serving the Philippines.

Best Short Term Investments In October 2023

BPI’s financial highlights are significant with continued growth in revenue, net income, balance sheet total, deposits and capital. We believe that BPI will maintain its superior position for several years. 12. GT Capital Holdings (GTCAP)

GT Capital Holdings (stock code: GTCAP) is one of the country’s largest conglomerates with interests in banking, real estate development, car assembly, imports, infrastructure, utilities, finance and insurance.

Because it is the holding company for many powerful companies in the Philippines including Metrobank, Toyota, AXA, Metro Pacific Investments, Federal Land and many others.

GTCAP belongs to major stock market indices such as PSEI, FTSE All-World Index and MSCI Philippine Index. 13. Puregold (PGOLD)

Best Long Term Investments For 2022 In Canada

Puregold (stock code: PGOLD) is one of the fastest growing grocery chains in the Philippines. It has more than 300 supermarket chains across the country. The company has a market capitalization of over PHP 83 billion Why should you invest in Puregold stock?

Because it’s like Walmart in the Philippines. It is well placed in the retail industry and has very loyal buyers. Puregold also has S&R, QSR, NE Bodega and Budgetlane branches.

Universal Robina Corporation (Stock Code: URC) is a food and beverage giant based in the Philippines with a strong presence in the ASEAN and Oceania markets. It is currently capped at £258 billion Why should you invest in URC shares?

Because URC has growing markets in the Philippines, China, Hong Kong, Indonesia, Malaysia, Oceania, Singapore, Thailand and Vietnam. The company’s portfolio includes famous brands such as Chippy, Piattos, Cream-O, Nips, Cloud 9, C2, Great Taste, Swiss Miss, Nissin, Vitasoy and many others. 15. Metrobank (MBT)

Best Long Term Investments 2023

Metrobank (stock code: MBT) is one of the top 3 banks in the Philippines and has been around for over 50 years.

Long term high yield investments, what are long term investments, long term stock investments, best short term stock investments, great long term stock investments, best long term investments, best long term crypto investments, the best long term investments, best long term investments for retirement, best safe long term investments, types of long term investments, long term roth ira investments.