Stock Market Risk Management – Taking risks is important, but minimizing risks is even more important. Good risk management in an investment portfolio is the first step to achieving high returns in the stock market.

Stock investments are classified based on the characteristic of a strong correlation between risk and return. Higher risk means higher return and vice versa. Portfolio risk management is about identifying and assessing potential risks and developing strategies to achieve the greatest possible return from our equity portfolios.

Stock Market Risk Management

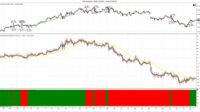

However, one of the most important stock market strategies is to reduce investment risk by following trends.

What Are Options? Types, Spreads, Example, And Risk Metrics

The problem with this strategy is being able to identify a trend because markets are dynamic and constantly changing.

The Indian stock market offers investors a range of financial products such as stocks, bonds, derivatives and mutual funds.

It protects the overall investment return from market volatility and if a particular sector or company performs unfavorably, other investments in the portfolio can provide balance within the investor’s portfolio.

Another stock market tip that investors forget to follow is to take the time to do your own research and due diligence before deciding to invest in the stock market.

Stock Market Risk: Analyzing And Finding Solutions

Setting financial goals before investing and focusing on short- and long-term goals will help investors get the maximum return on their investments in the stock market.

Developing a plan and strategy helps win the war. The same applies to investing in the Indian stock market.

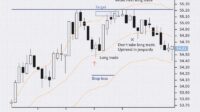

Successful investors set entry and exit prices in advance to calculate potential returns relative to the potential of stocks reaching those price levels.

On the other hand, unsuccessful traders invest without thinking about what prices they will buy and sell financial instruments at.

Risk/reward Ratio For Trading Financial Markets

They often trade on emotions; They hold their positions whenever the price falls in the hope of a trend reversal and do not book profits because they are eager to make even bigger profits when the price rises.

This is the price at which the investor is willing to sell their investment and make a profit.

Profit booking on stocks that approach resistance levels after big gains ensures investors sell them before they begin to consolidate and fall in price.

The stock market is risky and smart investors use portfolio risk management strategies to mitigate risk.

Stock Market Mentor On Linkedin: The Importance Of Risk Management In Trading Risk Management Is A…

Careful and timely use of various risk mitigation tools ensures that investors can maximize their profits through stock investing.

Conclusion:- Risk taking is important when talking about the stock market. But risk management is just as important as risk taking. In this article we try to explain how to manage portfolio risk in the stock market!

Meet Warren Buffet from India: “Rakesh Jhunjhunwala” Rakesh Jhunjhunwala started at $66.45 and is now worth $3 billion.

Complete Analysis of TCS Limited Hello, in today’s post we are going to do the complete analysis of Tata Consultancy Services Limited i.e. H. TCS Company, in which we also…

Risk Management In The Stock Market By Maheshwari Institute (micr)

What is a stock market dividend? Definition, Meaning and Types Do you know that you can make money not only by buying, investing or selling stocks but also from dividends? What is a dividend!

What is benevolence! Importance of Goodwill If you want to give your company a new identity or give it name recognition, you need to understand goodwill.

Simple Stock Selection Strategy with 6 Important Financial Indicators — Part 1. This article looks at six important financial parameters for stock selection. This strategy is covered in more detail on YouTube…

Stock Price Prediction Using Machine Learning In the world of finance, stock price prediction has always been a challenge that captures the imagination of investors, researchers and…

Stock Market Risk Powerpoint Ppt Template Bundles

Data Science in Credit Risk: Matching the Business Cycle and Downside Risks for PD and LGD… Welcome back! In my previous posts (PART 1 and 2) I introduced the basic terminology and building blocks for credit risk management in…

Value Investing with Python and Azure — Introduction I share my experiences as a quantitatively oriented value investor with simple but powerful tools

90% SUCCESSFUL?! Discover chart patterns that are too good to be true with TradeDots. Trading is a complex topic that can be difficult to understand. It goes against our natural inclination towards simplicity because we often…

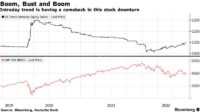

Support the strategy to make money day trading (no, really). Day trading. We were all warned about this. We are told that “95% of day traders lose money.” Combine that with oversupply… Risk management is a crucial aspect of stock trading that aims to minimize potential losses and protect capital. By implementing effective risk management strategies, traders can protect their investments and increase the likelihood of long-term success.

Trading Risk Management Strategy: The Ultimate Guide To Risk

Risk refers to the potential for loss, damage, or negative consequences that may result from an action or decision. In the context of stock trading, risk refers to the possibility of financial loss due to adverse market conditions, poor investment decisions, or unexpected events. It is an inherent and unavoidable aspect of investing and trading.

Risk management in stock trading is the process of identifying, evaluating and mitigating the risks associated with stock trading. This includes implementing strategies and measures to protect capital, minimize potential losses and increase the likelihood of achieving positive results. The goal of risk management is to strike a balance between risk and reward so that traders can manage market uncertainty more effectively

Risk management is used to minimize losses when the market turns against traders following an event. Although the temptation to take advantage of every opportunity exists for all traders. Effective risk management helps preserve and protect capital. Risk management strategies allow traders to adapt to changing market conditions. Risk management requires traders to conduct thorough research, analysis and assessment of potential risks.

1. Diversification: Diversifying your portfolio is important to reduce risk. Spreading your investments across different stocks, sectors, industries and asset classes can help reduce the impact of poor performance by a single stock or adverse market conditions.

Stock Market Volatility: Acting Vs. Reacting

2. Stop Loss Orders: Implementing stop loss orders is a popular risk management technique. A stop-loss order allows you to set a predetermined price at which you are willing to sell a stock to limit potential losses. If the stock price falls to or below this level, the order is automatically triggered, minimizing further losses.

3. Position Sizing: Determining the appropriate position size for each trade is crucial. The risk of having too much capital in a trade increases the potential for significant losses. Traders often use a percentage of their portfolio or a fixed dollar amount as a guide to limit the risk of a single trade.

4. Risk-Reward Ratio: Evaluating the risk-reward ratio helps traders estimate the potential profit versus potential loss for each trade. A favorable risk-reward ratio typically indicates that the potential reward outweighs the risk. Setting a minimum acceptable risk-reward ratio helps traders select trades with better potential returns.

5. Research and Analysis: Thorough research and analysis are crucial for making informed trading decisions. This includes examining company fundamentals, market trends, financial reports, press releases and technical indicators. By understanding the factors that influence stock prices, traders can make more informed decisions and reduce the likelihood of unexpected losses.

Risk: What It Means In Investing, How To Measure And Manage It

6. Set Realistic Expectations: Setting realistic expectations helps manage emotional reactions to market fluctuations. Understanding that stock trading involves both profits and losses, and that these losses are sometimes unavoidable, helps traders avoid impulsive decisions driven by fear or greed.

7. Risk Capital Allocation: It is important to allocate a certain portion of your total capital as risk capital. This is the amount of money you are willing to risk on the stock market while investing the rest in less volatile or safer investments. By limiting risk capital risk, traders protect themselves from excessive losses and maintain financial stability.

8. Continuous Monitoring and Review: Regular monitoring of your businesses and portfolio is crucial for timely identification and resolution of potential risks. Stay up to date with relevant news, earnings reports and market developments. Conduct regular reviews to assess the performance of your businesses and make necessary adjustments to your risk management strategies.

Always remember that risk management is a dynamic process and requires constant adjustment based on market conditions and personal trading goals. Developing a disciplined approach and sticking to your risk management strategies can help you navigate the uncertainties of stock trading more effectively.

Infographic Risk Management Template. Icons In Different Colors. Include Market Trend, Risk Investment, Capital, Identification Stock Vector

By implementing effective risk management strategies, traders aim to protect their capital, maintain long-term profitability, and improve the overall profitability of their stock trading activities.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

We are talking about risk management here, i.e. stock trading. If you want to know more, read the entire article.

If you want to know about risk management and its strategies, nothing will be written about it in this article. Comment your questions. We will do our best to answer your questions.

Financial Uncertainty Or Challenge Concept, Surviving And Thriving In Investment Stock Market Volatility, Risk Management Or Market Fluctuation, Businessman With Umbrella Walking On Volatile Chart. 25682185 Vector Art At Vecteezy

Low risk stock market investments, stock portfolio risk management, stock market risk, bank market risk management, stock market risk management strategies, financial market risk management, stock risk management, market risk management, market risk management course, market risk management software, capital market risk management, risk management stock trading.